In an article that has been published at Taylor & Francis Online, ‘Carbon Markets for Carbon Dioxide Removal’, Injy Johnstone, Sabine Fuss, Nadine Walsh and Robert Hoglund have presented the role played by CDR transactions in the voluntary carbon market and identified the ways in which CDR activities can grow as components of the voluntary and compliance carbon markets.

Key takeaways:

- Carbon markets can be used to achieve a wide variety of climate mitigation goals through the implementation of projects that do not emit, decrease the amount of or remove greenhouse gases.

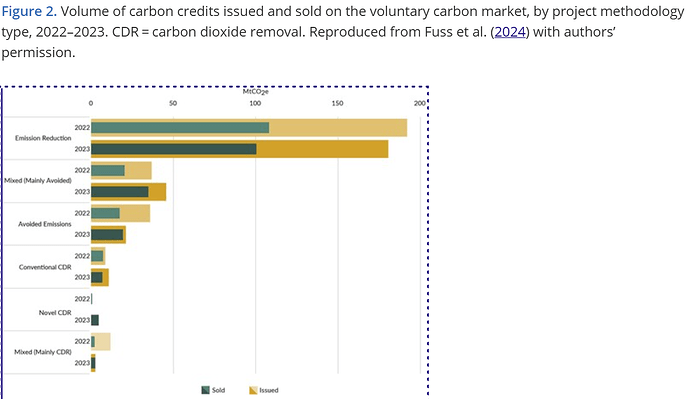

- Carbon markets have prevalently been used for activities that do not emit or decrease the amount of greenhouse gases up until now, with CDR making up the minority of the credits issues.

- CDR credits, particularly those that are issued for methods that make use of technology (novel CDR), are not highly sought after by potential buyers as their price is considerably higher and they lack technological maturity compared to credits sold for other mitigation activities. In addition, while the market for conventional CDR methods enjoys maturity and makes use of carbon crediting registries, the market for novel CDR credits does not possess such features as it has started operating more recently.

- Nonetheless, in 2023, the number of credits sold for conventional CDR activities declined by a small margin and those that have been purchased for prospective activities making use of novel CDR methods increased sevenfold.

- The number of credits issued for novel CDR methods kept increasing in 2025. Even though the credits issued for conventional CDR made up the majority, the voluntary carbon market (‘VCM’) facilitated the growth of novel CDR to a much greater extent compared to conventional CDR.

- Most of the activities traded in the VCM that involve CDR are being carried out in the Global North, especially in North America, owing to the significant number of forestry activities in this region. Similarly, the great majority of the CDR companies engaging in novel CDR activities are located in Europe and North America, with biochar and direct air capture being the most frequently used methods.

- Nonetheless, significant physical potential exists in all regions of the world for fostering CDR growth.

- This potential can be realized through the use of VCM and compliance markets.

- As the VCM for novel CDR activities grows, it is anticipated that more credits will be issued following the completion of CDR activities. As a result, purchase of credits before CDR activities are underway will occur less frequently, a trend reflecting the trade in credits for other mitigation activities.

- The availability of insurance can foster the reliability of CDR by mitigating risks that may emerge during the course of CDR activities as well as those that pertain to leakage.

- There are a few frameworks with respect to use of CDR credits by corporations making climate mitigation claims. However, policy-makers should have recourse to regulatory tools in a more systematic manner to establish rules with broad applicability.

- In addition, standards surrounding the quality of the CDR credits issued in the VCM such as the rules regarding monitoring, reporting and verification (‘MRV’) can be enhanced.

- Compliance markets better increase the odds in favor of demand for CDR compared to the VCM. CDR’s incorporation into compliance markets is currently at a nascent stage. This trend can further grow by having recourse to two different options.

- First, CDR credits can be incorporated into a compliance market, paving the way for the discharge of compliance obligations partially or entirely through the use of carbon credits. The use of this option can be subjected to limitations pertaining to the type of CDR credits.

- Second, CDR activities, rather than credits, can be incorporated into compliance markets. This course of action should be selected once suitable MRV schemes are in place to pave the way for the incorporation of credible CDR activities without hampering actions geared towards emission reduction.

- Lastly, the use CDR credits under Article 6 of the Paris Agreement and CORSIA, the compliance scheme for airlines, also offers avenues for raising funds for CDR.

Read the full paper here: https://www.tandfonline.com/doi/full/10.1080/14693062.2025.2478288#d1e351